Navigating Property in Cabell County: A Comprehensive Guide to the Tax Map

Related Articles: Navigating Property in Cabell County: A Comprehensive Guide to the Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Property in Cabell County: A Comprehensive Guide to the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Property in Cabell County: A Comprehensive Guide to the Tax Map

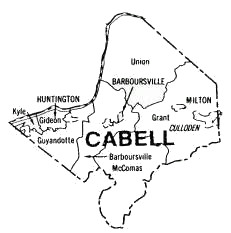

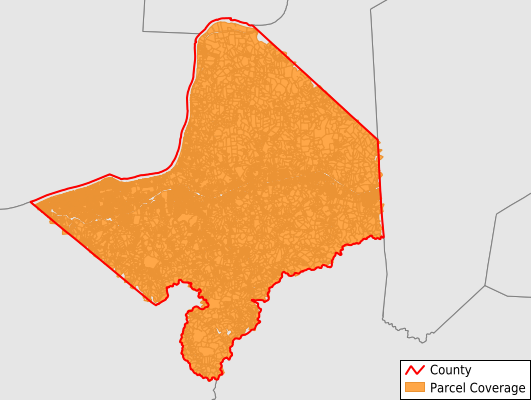

Cabell County, nestled in the heart of West Virginia, is home to a diverse landscape of residential, commercial, and industrial properties. Understanding the layout and ownership of these properties is crucial for various stakeholders, including residents, businesses, developers, and government agencies. This is where the Cabell County Tax Map, a vital resource for property information, comes into play.

What is the Cabell County Tax Map?

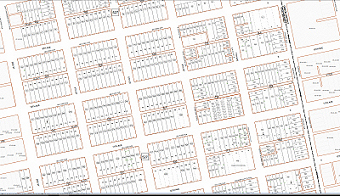

The Cabell County Tax Map is a comprehensive digital and physical representation of all taxable properties within the county. It serves as a detailed visual guide, providing crucial information about each property, including:

- Property Location: Precise coordinates and addresses are meticulously recorded, enabling easy identification and navigation.

- Property Boundaries: The map delineates the exact boundaries of each property, ensuring clarity in ownership and legal descriptions.

- Property Ownership: Details about the current owner, including their name and contact information, are readily available.

- Property Classification: The map categorizes properties based on their usage, such as residential, commercial, industrial, or agricultural, facilitating efficient property assessment and taxation.

- Property Value: An assessment of the property’s market value is recorded, serving as the foundation for calculating property taxes.

Benefits of Utilizing the Cabell County Tax Map

The Cabell County Tax Map offers a plethora of benefits to various stakeholders:

For Property Owners:

- Transparency in Assessment: The map provides a clear understanding of how their property is valued and taxed, allowing for potential appeals if discrepancies arise.

- Accurate Property Information: The map serves as a reliable source for verifying property details, ensuring legal compliance and accurate records.

- Property Management: Owners can easily track changes in property ownership, boundaries, and assessments, facilitating effective property management.

For Real Estate Professionals:

- Market Analysis: The map offers valuable insights into property trends, market values, and potential development opportunities, aiding in informed decision-making.

- Property Due Diligence: The map facilitates thorough property investigations, enabling real estate professionals to assess risks and opportunities associated with specific properties.

- Client Services: The map empowers real estate professionals to provide accurate and up-to-date information to clients, enhancing trust and satisfaction.

For Developers:

- Site Selection: The map helps identify potential development sites, considering factors such as property availability, zoning regulations, and infrastructure accessibility.

- Project Planning: The map facilitates detailed project planning by providing comprehensive information about property boundaries, utilities, and existing structures.

- Investment Decisions: The map assists in evaluating potential investments by providing data on property values, tax implications, and development feasibility.

For Government Agencies:

- Tax Administration: The map enables efficient tax collection by providing accurate property information and facilitating the assessment process.

- Land Use Planning: The map supports informed land use decisions by providing insights into property ownership, zoning regulations, and development trends.

- Emergency Response: The map assists emergency services in quickly locating properties and navigating complex areas during critical incidents.

Accessing the Cabell County Tax Map

The Cabell County Tax Map is readily accessible through various channels:

- Cabell County Assessor’s Office: The Assessor’s Office provides physical copies of the tax map, allowing for detailed examination and analysis.

- Online Mapping Platforms: The Assessor’s Office may offer online access to the tax map through dedicated mapping platforms, enabling interactive exploration and data retrieval.

- Third-Party Services: Several third-party companies specialize in property data and mapping services, offering access to Cabell County’s tax map with additional features and functionalities.

FAQs Regarding the Cabell County Tax Map

1. How Often is the Cabell County Tax Map Updated?

The Cabell County Tax Map is typically updated annually to reflect changes in property ownership, boundaries, and assessments. However, the frequency of updates may vary depending on the specific information being revised.

2. Can I Request a Specific Property Detail from the Tax Map?

Yes, the Cabell County Assessor’s Office can provide specific property information upon request, including ownership details, property boundaries, and assessment data.

3. How Can I Report Errors or Discrepancies on the Tax Map?

The Cabell County Assessor’s Office welcomes feedback and encourages residents to report any errors or discrepancies on the tax map. Contact information for reporting such issues can be found on the Assessor’s Office website or through their office.

4. Are There Fees Associated with Accessing the Tax Map?

The Cabell County Assessor’s Office may charge a nominal fee for accessing specific property information or obtaining physical copies of the tax map. However, access to the online version of the map is often free of charge.

5. What are the Legal Implications of Using the Cabell County Tax Map?

The Cabell County Tax Map is a valuable resource for understanding property information, but it is important to note that it is not a substitute for legal advice. If you have legal questions regarding property ownership, boundaries, or assessments, consult with an attorney specializing in real estate law.

Tips for Utilizing the Cabell County Tax Map Effectively

- Familiarize Yourself with the Map’s Legend: Understand the symbols and abbreviations used on the tax map to interpret property information accurately.

- Utilize Search Functions: If available, utilize the map’s search functions to quickly locate specific properties by address, owner name, or parcel number.

- Verify Information with Official Sources: Always confirm property details obtained from the tax map with official sources, such as the Cabell County Assessor’s Office or property records.

- Consider Consulting with Professionals: For complex property transactions or legal matters, consult with a qualified real estate professional or attorney.

- Stay Updated on Map Revisions: Regularly check for updates to the Cabell County Tax Map to ensure you have access to the most current information.

Conclusion

The Cabell County Tax Map serves as a vital resource for navigating property information within the county. By providing detailed and accurate data on property ownership, boundaries, and assessments, the map empowers residents, businesses, developers, and government agencies to make informed decisions and manage property effectively. Understanding and utilizing the Cabell County Tax Map is crucial for ensuring transparency, legal compliance, and informed decision-making in property-related matters.

Closure

Thus, we hope this article has provided valuable insights into Navigating Property in Cabell County: A Comprehensive Guide to the Tax Map. We appreciate your attention to our article. See you in our next article!