Navigating Retirement: A Comprehensive Guide to Kiplinger’s Retirement Map

Related Articles: Navigating Retirement: A Comprehensive Guide to Kiplinger’s Retirement Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Retirement: A Comprehensive Guide to Kiplinger’s Retirement Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Retirement: A Comprehensive Guide to Kiplinger’s Retirement Map

Retirement planning is a complex endeavor, requiring careful consideration of factors like finances, lifestyle preferences, and healthcare needs. To aid individuals in this process, Kiplinger, a renowned financial publication, has developed a valuable resource known as the "Retirement Map." This comprehensive tool provides a detailed roadmap for navigating the transition into retirement, encompassing crucial aspects such as financial planning, healthcare considerations, and lifestyle choices.

Understanding the Purpose and Scope of Kiplinger’s Retirement Map

Kiplinger’s Retirement Map serves as a comprehensive guide, offering a structured framework for individuals to approach their retirement planning. It aims to provide clarity and direction by:

- Defining Retirement Goals: The map encourages individuals to articulate their retirement aspirations, encompassing financial independence, travel plans, and desired lifestyle.

- Assessing Financial Readiness: By analyzing current financial resources, including savings, investments, and potential income sources, the map helps individuals determine their financial preparedness for retirement.

- Creating a Retirement Budget: The map provides guidance on developing a realistic budget that aligns with retirement goals and accounts for anticipated expenses.

- Navigating Healthcare Costs: It highlights the significance of healthcare costs in retirement and offers insights into Medicare, supplemental insurance, and long-term care planning.

- Exploring Lifestyle Options: The map encourages individuals to consider their desired retirement lifestyle, factoring in location, hobbies, and social connections.

- Addressing Tax Implications: It provides information on tax implications of retirement income, including Social Security benefits, pensions, and withdrawals from retirement accounts.

- Planning for Estate and Legacy: The map encourages individuals to consider estate planning, including wills, trusts, and beneficiary designations.

Key Components of Kiplinger’s Retirement Map

Kiplinger’s Retirement Map is structured around several key components, each addressing a specific aspect of retirement planning:

1. Financial Planning: This section focuses on assessing financial readiness for retirement, including:

- Calculating Retirement Savings Needs: This involves estimating expenses and determining the required savings to sustain a desired lifestyle.

- Evaluating Investment Strategies: The map provides insights into different investment options, including stocks, bonds, and real estate, considering risk tolerance and time horizon.

- Optimizing Social Security Benefits: It outlines strategies for maximizing Social Security benefits, including claiming options and potential tax implications.

- Managing Retirement Income Sources: The map explores various income sources in retirement, such as pensions, annuities, and part-time work, to ensure a consistent income stream.

2. Healthcare Planning: This section highlights the importance of healthcare planning in retirement, covering:

- Understanding Medicare Coverage: The map explains Medicare eligibility, different parts of the program, and potential cost implications.

- Exploring Supplemental Insurance Options: It discusses the benefits and drawbacks of supplemental insurance, such as Medigap and Medicare Advantage plans, to cover gaps in Medicare coverage.

- Planning for Long-Term Care: The map emphasizes the importance of planning for potential long-term care needs, including assisted living, nursing homes, and home health services.

3. Lifestyle Planning: This section encourages individuals to consider their desired lifestyle in retirement, focusing on:

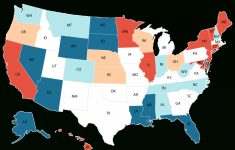

- Choosing a Retirement Location: The map explores various factors to consider when selecting a retirement location, such as cost of living, climate, and access to amenities.

- Pursuing Hobbies and Interests: It emphasizes the importance of engaging in hobbies and activities that bring joy and purpose in retirement.

- Maintaining Social Connections: The map underscores the significance of maintaining social connections and building new relationships in retirement.

4. Estate Planning: This section focuses on ensuring a smooth transition of assets and legacy, covering:

- Creating a Will: The map encourages individuals to draft a will outlining the distribution of assets upon death.

- Establishing a Trust: It explores the benefits of establishing a trust to manage assets and minimize potential tax implications.

- Designating Beneficiaries: The map highlights the importance of designating beneficiaries for retirement accounts, insurance policies, and other assets.

Benefits of Utilizing Kiplinger’s Retirement Map

Kiplinger’s Retirement Map offers several benefits for individuals planning for retirement:

- Comprehensive Guidance: The map provides a holistic framework for retirement planning, encompassing all essential aspects.

- Clear and Concise Information: It presents complex financial and healthcare concepts in an understandable and accessible manner.

- Practical Strategies: The map offers actionable strategies and tips for navigating retirement challenges.

- Personalized Approach: It encourages individuals to tailor their retirement plans to their unique circumstances and goals.

- Regular Updates: Kiplinger regularly updates the map to reflect changes in regulations, market conditions, and retirement trends.

FAQs about Kiplinger’s Retirement Map

1. Is Kiplinger’s Retirement Map suitable for everyone?

Kiplinger’s Retirement Map is a valuable resource for individuals approaching retirement or those already in retirement. It provides a comprehensive framework for planning, regardless of income level or retirement goals.

2. How can I access Kiplinger’s Retirement Map?

Kiplinger’s Retirement Map is available online through their website, providing access to the full content and downloadable resources.

3. Is there a cost associated with using Kiplinger’s Retirement Map?

Kiplinger’s Retirement Map is available for free access on their website. However, some additional resources, such as personalized financial planning tools, may require a subscription.

4. Does Kiplinger’s Retirement Map provide financial advice?

Kiplinger’s Retirement Map provides general guidance and information on retirement planning. It is not intended to be a substitute for professional financial advice. Individuals should consult with a qualified financial advisor for personalized guidance.

5. How often should I review my retirement plan using Kiplinger’s Retirement Map?

It is recommended to review your retirement plan annually or whenever there are significant life changes, such as a job change, health issues, or market fluctuations.

Tips for Utilizing Kiplinger’s Retirement Map Effectively

- Start Early: Begin planning for retirement as early as possible to maximize savings and investment growth.

- Set Realistic Goals: Define clear and achievable retirement goals to guide your planning.

- Gather Financial Information: Compile a comprehensive list of assets, debts, and income sources to accurately assess your financial situation.

- Seek Professional Advice: Consult with a qualified financial advisor for personalized guidance and tailored strategies.

- Stay Informed: Stay updated on changes in retirement regulations, market conditions, and healthcare options.

Conclusion

Kiplinger’s Retirement Map is a valuable resource for individuals navigating the complexities of retirement planning. By providing a comprehensive framework, practical strategies, and clear information, the map empowers individuals to take control of their retirement journey. Whether you are just beginning to plan or are already in retirement, utilizing this resource can help you achieve a fulfilling and financially secure future. Remember, retirement planning is an ongoing process, and regular review and adjustments are crucial to ensure your plans remain aligned with your evolving needs and goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating Retirement: A Comprehensive Guide to Kiplinger’s Retirement Map. We hope you find this article informative and beneficial. See you in our next article!