Navigating The Landscape: Understanding Franklin County, Pennsylvania’s Tax Map

Navigating the Landscape: Understanding Franklin County, Pennsylvania’s Tax Map

Related Articles: Navigating the Landscape: Understanding Franklin County, Pennsylvania’s Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape: Understanding Franklin County, Pennsylvania’s Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Landscape: Understanding Franklin County, Pennsylvania’s Tax Map

- 2 Introduction

- 3 Navigating the Landscape: Understanding Franklin County, Pennsylvania’s Tax Map

- 3.1 Unveiling the Structure: A Geographic and Taxological Framework

- 3.2 Accessing the Map: A Gateway to Information

- 3.3 Unveiling the Benefits: A Multifaceted Resource

- 3.4 Frequently Asked Questions

- 3.5 Tips for Utilizing the Franklin County Tax Map

- 3.6 Conclusion

- 4 Closure

Navigating the Landscape: Understanding Franklin County, Pennsylvania’s Tax Map

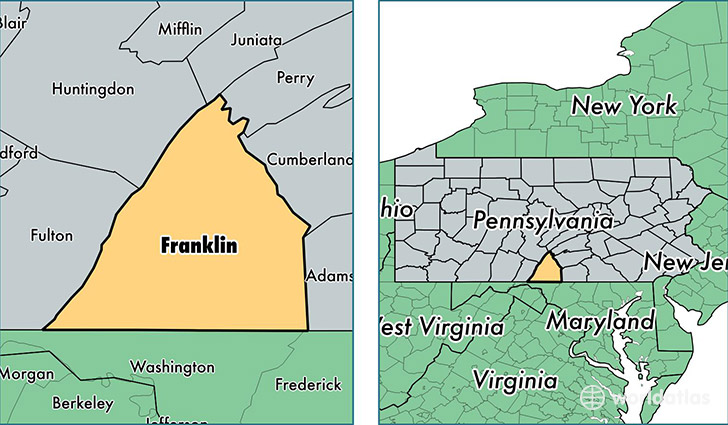

Franklin County, Pennsylvania, a vibrant region nestled in the heart of the state, boasts a rich history, diverse economy, and a captivating landscape. For those seeking to understand the intricate web of property ownership and taxation within this county, the Franklin County Tax Map serves as an indispensable tool. This comprehensive guide delves into the intricacies of the Franklin County Tax Map, exploring its structure, uses, and significance for residents, businesses, and property stakeholders alike.

Unveiling the Structure: A Geographic and Taxological Framework

The Franklin County Tax Map is a meticulously crafted digital representation of the county’s land parcels, meticulously organized and presented for easy navigation. It operates as a visual database, providing a detailed overview of property boundaries, ownership, and tax information. The map is structured around a hierarchical system, encompassing various levels of detail:

- Municipalities: The map is initially divided into municipalities, encompassing townships, boroughs, and cities within Franklin County. This initial division allows users to quickly pinpoint their area of interest.

- Tax Districts: Within each municipality, the map is further divided into tax districts, reflecting distinct geographical areas or subdivisions for tax purposes.

- Parcels: The fundamental unit of the Franklin County Tax Map is the parcel, representing individual pieces of land with unique identifiers. Each parcel is assigned a distinct number, facilitating its identification and retrieval of associated information.

-

Property Attributes: Each parcel is accompanied by a wealth of information, including:

- Owner Name and Address: The map clearly identifies the current owner of each parcel, along with their contact details.

- Property Address: The map displays the physical address associated with the parcel, enabling users to locate the property on the ground.

- Land Use: The map indicates the primary land use classification for each parcel, providing insights into its current function, such as residential, commercial, or agricultural.

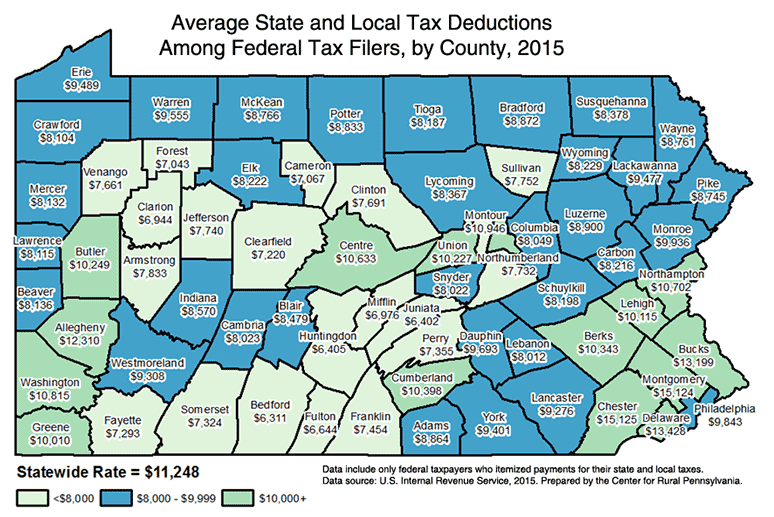

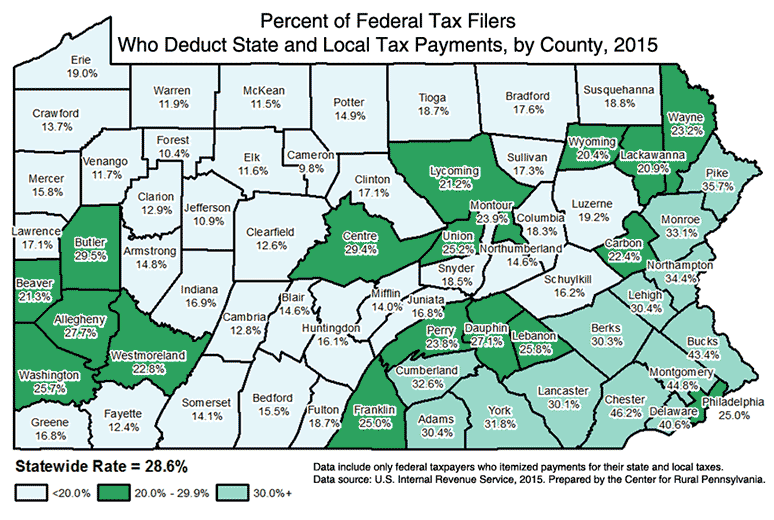

- Property Value: The map reveals the assessed value of each parcel, reflecting its estimated worth for tax purposes. This value forms the basis for calculating property taxes.

- Tax Information: The map details the tax rates applicable to each parcel, allowing users to determine their tax liability.

Accessing the Map: A Gateway to Information

The Franklin County Tax Map is readily accessible through various platforms, providing users with convenient access to vital information:

- Franklin County Website: The official website of Franklin County provides an online interface for accessing the tax map. Users can navigate through the municipality, tax district, and parcel levels to access detailed information.

- GIS Mapping Systems: Advanced Geographic Information Systems (GIS) platforms, such as ArcGIS, are often employed to display and analyze the Franklin County Tax Map data. These systems offer sophisticated mapping capabilities and analytical tools for in-depth exploration.

- Paper Copies: While digital access is prevalent, printed copies of the Franklin County Tax Map are also available upon request from the county assessor’s office.

Unveiling the Benefits: A Multifaceted Resource

The Franklin County Tax Map serves as a vital resource for a diverse array of stakeholders, offering valuable insights and facilitating informed decision-making:

- Property Owners: The map empowers property owners to understand their property boundaries, assess their tax liability, and track changes in ownership and valuation over time. It facilitates informed decision-making regarding property management, taxes, and potential sales.

- Real Estate Professionals: Real estate agents, brokers, and appraisers rely heavily on the tax map to gather property information, assess market values, and identify potential investment opportunities. The map provides a comprehensive understanding of the local real estate landscape.

- Government Agencies: The tax map is an essential tool for county and municipal governments in managing property records, assessing tax revenues, and planning for future development. It serves as a foundation for land use planning, infrastructure development, and emergency response.

- Businesses: Businesses utilize the tax map to identify potential locations for expansion, assess property values for investment purposes, and understand the regulatory landscape surrounding land use.

- Community Members: The tax map empowers residents to gain insights into their local community, track development trends, and engage in informed discussions about land use and taxation.

Frequently Asked Questions

1. How can I find my property on the Franklin County Tax Map?

To locate your property, you will need its address or parcel number. Navigate to the Franklin County website and access the tax map. Enter the address or parcel number in the search field. The map will then display your property’s location and associated information.

2. What information is available on the tax map?

The Franklin County Tax Map provides a wealth of information, including property boundaries, ownership details, property address, land use classification, assessed value, and tax information.

3. How often is the tax map updated?

The Franklin County Tax Map is regularly updated to reflect changes in property ownership, land use, and assessments. Updates are typically made annually to ensure the map’s accuracy.

4. Can I access the tax map on my mobile device?

Yes, the Franklin County Tax Map is often accessible through mobile-friendly versions of the county website or dedicated mobile applications. Check the county website for specific details on mobile access.

5. Who can I contact for assistance with the tax map?

For questions or assistance regarding the Franklin County Tax Map, contact the Franklin County Assessor’s Office. They can provide guidance on map navigation, property information, and related inquiries.

Tips for Utilizing the Franklin County Tax Map

- Start with a Clear Objective: Before navigating the map, define your specific goal. Are you seeking property information, assessing tax liability, or researching potential investment opportunities?

- Utilize Search Functions: The tax map features search functionalities for addresses, parcel numbers, and other key attributes. Utilize these tools to quickly locate your desired properties.

- Explore Different Layers: The map often offers various layers, such as land use, zoning, and property values. Experiment with these layers to gain a comprehensive understanding of the surrounding context.

- Consult Documentation: Refer to the county website or assessor’s office for detailed documentation on the tax map’s structure, features, and usage.

- Contact for Assistance: If you encounter difficulties or have questions, do not hesitate to contact the Franklin County Assessor’s Office for support.

Conclusion

The Franklin County Tax Map serves as a cornerstone for understanding property ownership, taxation, and land use within the region. Its comprehensive nature, accessibility, and wealth of information empower residents, businesses, and government agencies to make informed decisions, navigate the complexities of property ownership, and contribute to the sustainable development of Franklin County. By embracing the insights offered by the tax map, stakeholders can foster a more informed and prosperous future for this vibrant region.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape: Understanding Franklin County, Pennsylvania’s Tax Map. We thank you for taking the time to read this article. See you in our next article!