Navigating the Landscape: Understanding Perry County Tax Maps

Related Articles: Navigating the Landscape: Understanding Perry County Tax Maps

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape: Understanding Perry County Tax Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape: Understanding Perry County Tax Maps

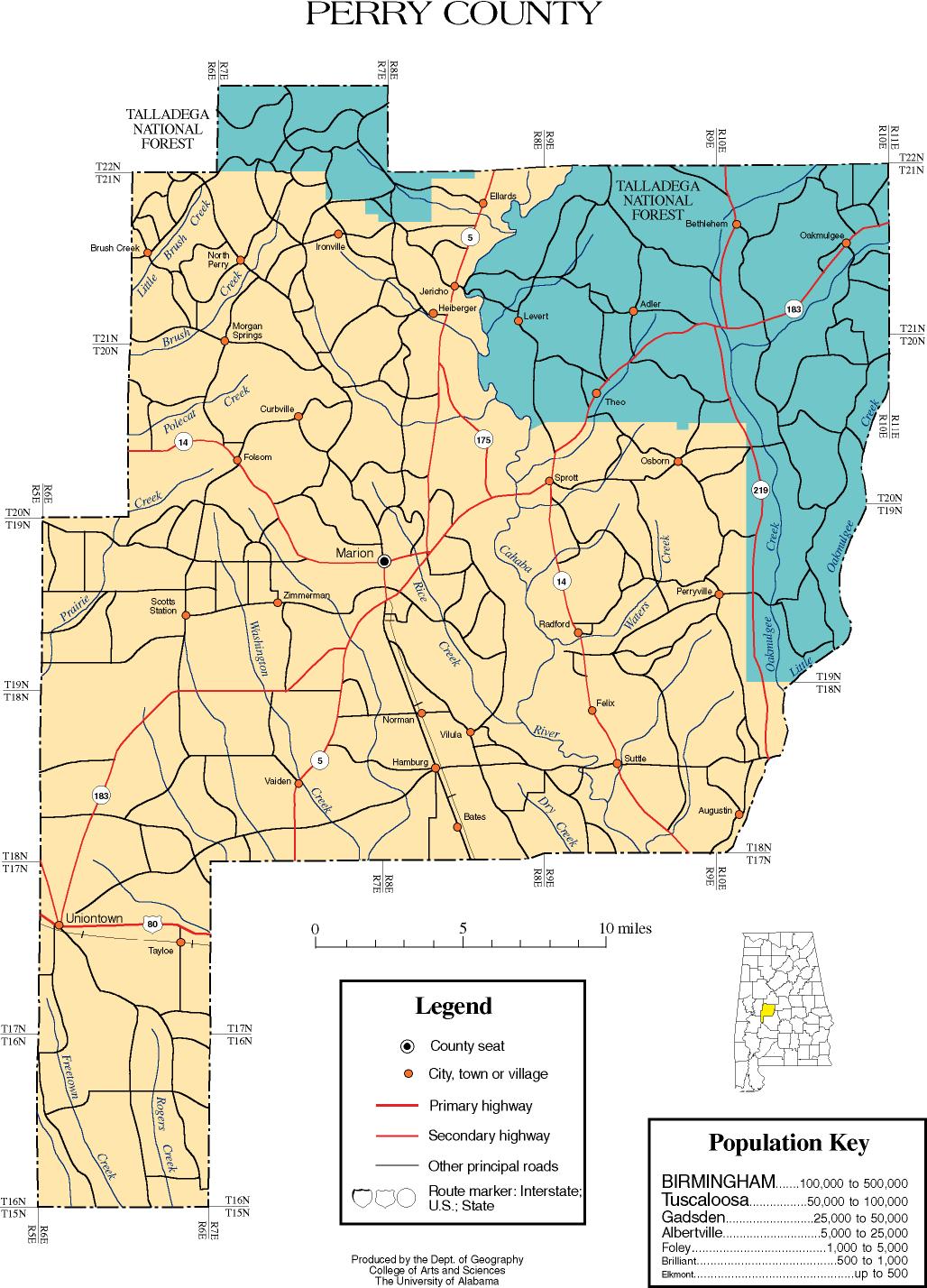

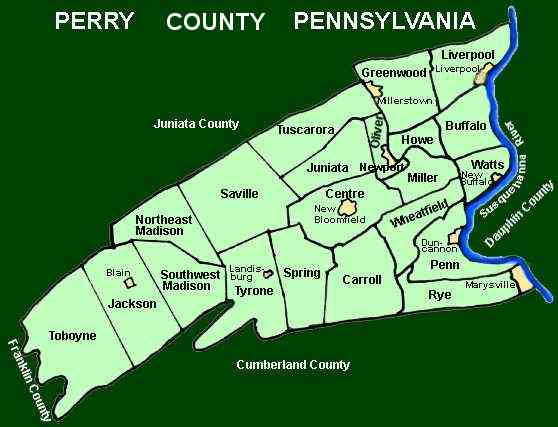

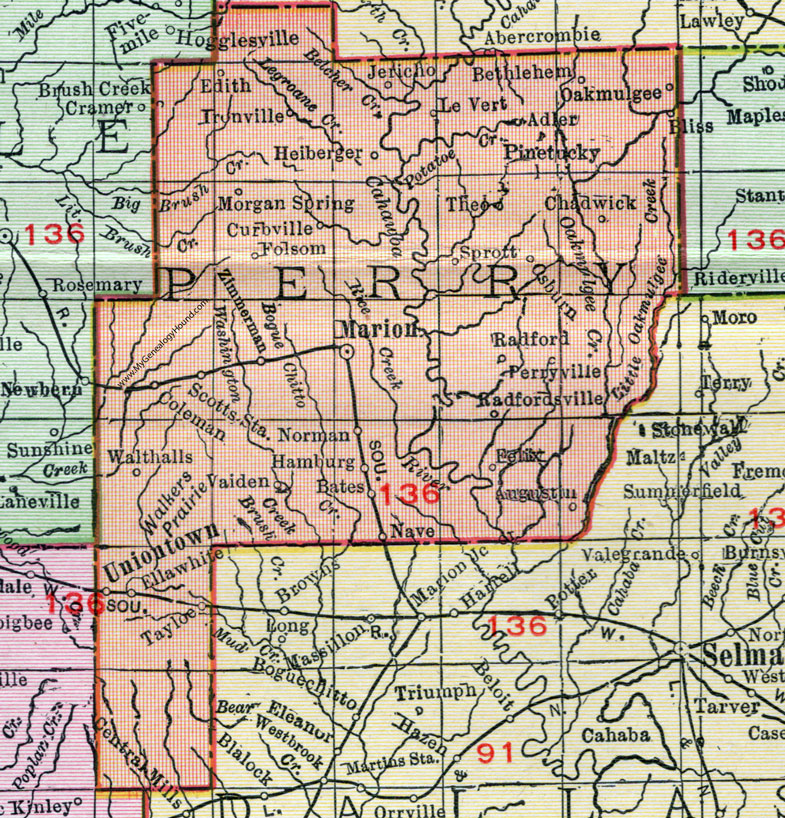

Perry County tax maps serve as a crucial tool for understanding the intricate web of property ownership and valuation within the county. These maps, meticulously crafted and maintained, provide a visual representation of the county’s land parcels, outlining their boundaries, identifying owners, and revealing assessed values. This comprehensive guide delves into the intricacies of Perry County tax maps, highlighting their significance and practical applications.

A Visual Representation of Ownership and Value:

Perry County tax maps are more than just static diagrams; they are dynamic documents that evolve with changes in property ownership, development, and assessed values. Each parcel is assigned a unique identifier, allowing for precise tracking and referencing. The maps visually depict the geographic layout of the county, showcasing the distribution of properties, their size, and their relationship to surrounding parcels. This visual representation facilitates a clear understanding of property ownership patterns and land use within the county.

Key Elements of Perry County Tax Maps:

- Parcel Identification: Each property within Perry County is assigned a unique parcel number, enabling easy identification and tracking. This number serves as a primary key for accessing detailed property information within the county’s tax database.

- Property Boundaries: The maps clearly define the boundaries of each parcel, ensuring accurate representation of land ownership and preventing disputes. These boundaries are typically based on official surveys and legal descriptions, ensuring their accuracy and reliability.

- Property Owners: The maps indicate the names of the current property owners, providing a direct link to individuals or entities responsible for the land. This information is crucial for tax collection, property transactions, and other legal purposes.

- Assessed Value: Each parcel is assigned an assessed value, reflecting its estimated market value for tax purposes. This value is determined by the county assessor’s office, taking into account factors such as property type, location, size, and improvements.

- Land Use: The maps may include information on the designated land use for each parcel, such as residential, commercial, agricultural, or industrial. This information is valuable for understanding the overall development patterns and economic activity within the county.

The Importance of Perry County Tax Maps:

Perry County tax maps play a pivotal role in various aspects of county administration and community development. They serve as the foundation for:

- Tax Assessment and Collection: Accurate and up-to-date tax maps are essential for the efficient assessment and collection of property taxes. They provide the basis for calculating tax liabilities and ensuring fair distribution of the tax burden.

- Property Transactions: Real estate transactions, including buying, selling, and transferring property ownership, heavily rely on tax maps. They provide clear information on property boundaries, ownership, and assessed values, facilitating smooth and legally sound transactions.

- Land Development and Planning: Perry County tax maps are invaluable tools for land development and planning initiatives. They provide a comprehensive overview of available land, zoning regulations, and property ownership, enabling informed decision-making for infrastructure projects, housing developments, and other land use changes.

- Emergency Response and Disaster Management: In emergency situations, tax maps can be crucial for first responders and emergency management teams. They provide accurate information on property locations, access points, and potential hazards, facilitating efficient response and resource allocation.

- Historical Research and Genealogy: Perry County tax maps offer a glimpse into the county’s historical development, providing insights into land ownership patterns, population shifts, and economic changes over time. This historical data is valuable for researchers and genealogists seeking to understand the county’s past.

Accessing Perry County Tax Maps:

Perry County tax maps are typically accessible through various channels:

- County Assessor’s Office: The Perry County Assessor’s Office is the primary source for tax maps and related property information. They often maintain online databases and interactive map viewers, allowing public access to the maps.

- County Website: Many county websites offer downloadable versions of tax maps, providing convenient access for residents and businesses.

- Real Estate Websites: Several real estate websites, such as Zillow, Realtor.com, and Redfin, incorporate tax map data into their property listings, enabling users to view parcel boundaries and ownership information.

- GIS Data Providers: Geographic Information System (GIS) data providers, such as Esri, offer comprehensive datasets that include Perry County tax maps, allowing professionals and researchers to access and analyze the data.

FAQs: Understanding Perry County Tax Maps

Q: What is the purpose of Perry County tax maps?

A: Perry County tax maps serve as a visual representation of property ownership and valuation, facilitating tax assessment, property transactions, land development planning, and emergency response efforts.

Q: How are Perry County tax maps updated?

A: Perry County tax maps are updated periodically to reflect changes in property ownership, development, and assessed values. These updates are typically driven by property sales, new construction, and reassessment cycles.

Q: Can I access Perry County tax maps online?

A: Yes, many counties, including Perry County, provide online access to their tax maps through their official websites, assessor’s office portals, or GIS data providers.

Q: How can I find a specific property on a Perry County tax map?

A: You can locate a specific property on a Perry County tax map by using the property’s address, parcel number, or owner’s name. Most online map viewers offer search functions for this purpose.

Q: What information can I find on a Perry County tax map?

A: Perry County tax maps typically display information such as parcel boundaries, property owners, assessed values, land use, and property addresses.

Q: Are Perry County tax maps legally binding documents?

A: While not legal documents themselves, Perry County tax maps are based on official surveys and legal descriptions, making them reliable sources of information for property boundaries and ownership.

Tips for Utilizing Perry County Tax Maps:

- Verify Information: Always verify the accuracy of information obtained from tax maps by contacting the Perry County Assessor’s Office or other relevant authorities.

- Use Multiple Sources: Consult multiple sources, such as online map viewers, county websites, and real estate websites, to ensure a comprehensive understanding of property data.

- Understand Limitations: Remember that tax maps are a snapshot in time and may not reflect the most recent changes in property ownership or development.

- Consult Professionals: For complex property transactions or land development projects, consult with legal professionals or real estate agents who can provide expert guidance.

Conclusion:

Perry County tax maps are indispensable tools for navigating the complex landscape of property ownership and valuation within the county. They provide a visual representation of land parcels, ownership information, and assessed values, facilitating efficient administration, informed decision-making, and effective community development. By understanding the purpose, content, and accessibility of these maps, individuals, businesses, and government agencies can leverage their power to achieve their respective goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape: Understanding Perry County Tax Maps. We thank you for taking the time to read this article. See you in our next article!