Navigating The Path To Homeownership In Missouri: A Guide To USDA Loan Eligibility

Navigating the Path to Homeownership in Missouri: A Guide to USDA Loan Eligibility

Related Articles: Navigating the Path to Homeownership in Missouri: A Guide to USDA Loan Eligibility

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Path to Homeownership in Missouri: A Guide to USDA Loan Eligibility. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Path to Homeownership in Missouri: A Guide to USDA Loan Eligibility

Missouri, with its rolling hills, vibrant cities, and diverse rural landscapes, offers a compelling environment for those seeking a peaceful and affordable life. However, the dream of homeownership can seem daunting, especially for individuals and families seeking to establish roots in rural areas. Fortunately, the United States Department of Agriculture (USDA) offers a valuable resource: the USDA Rural Development Loan program, designed to assist eligible individuals in purchasing homes in eligible rural areas. This comprehensive guide explores the intricacies of USDA loan eligibility in Missouri, providing a clear understanding of the program’s benefits, requirements, and the tools available to navigate the application process.

Understanding USDA Loan Eligibility in Missouri:

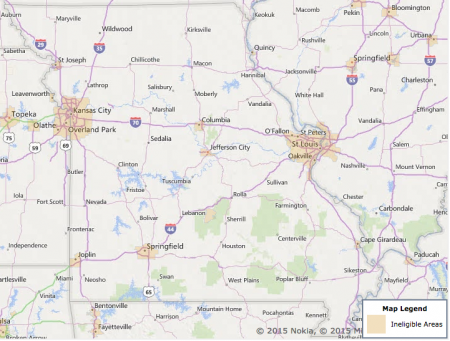

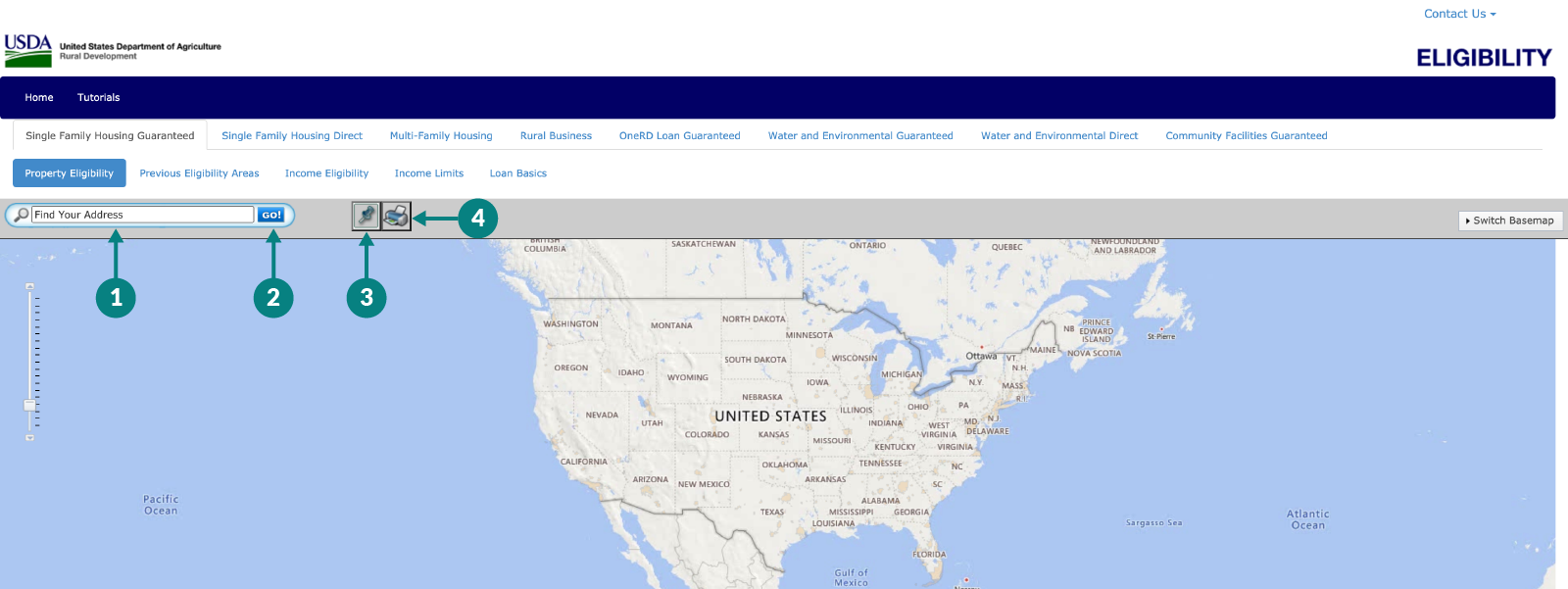

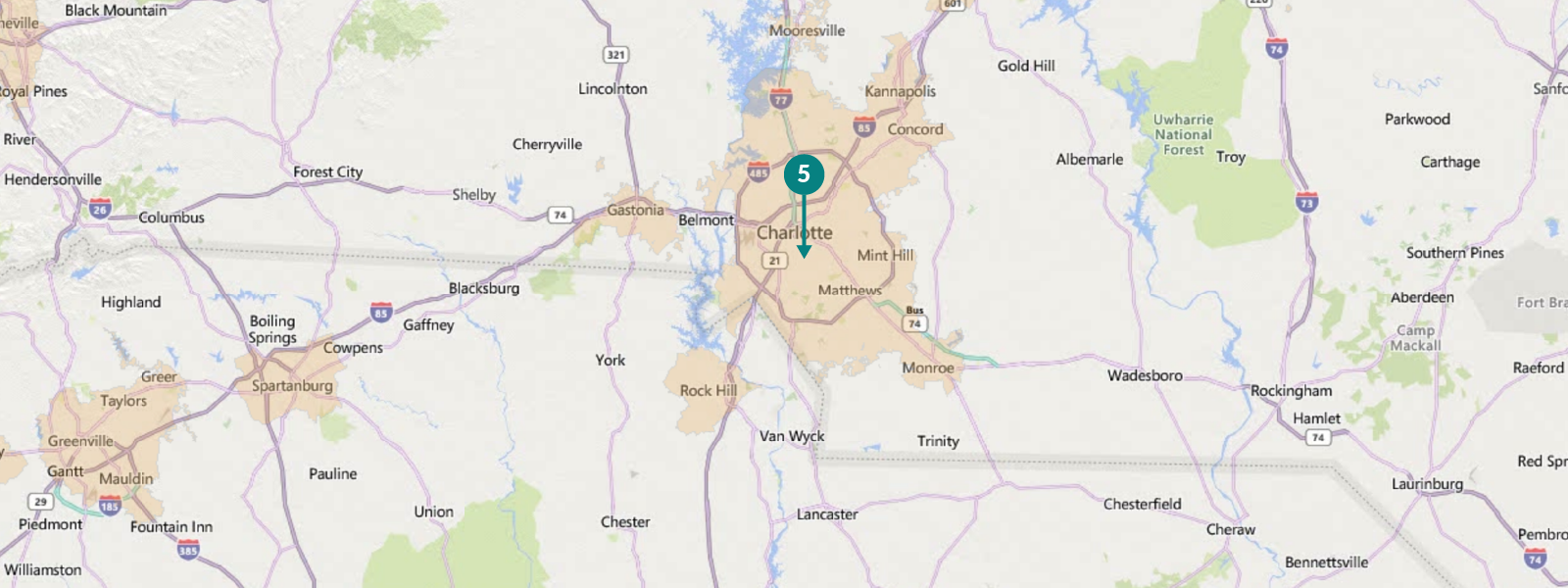

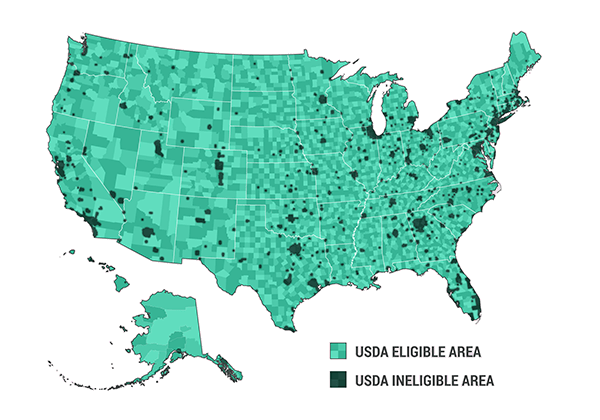

The USDA Rural Development Loan program is a government-backed loan designed to promote homeownership in rural areas. To qualify for a USDA loan in Missouri, a property must be located within an eligible rural area, defined by the USDA. This eligibility is determined by a map, commonly referred to as the "USDA Loan Map," which delineates the boundaries of eligible rural areas.

Navigating the USDA Loan Map of Missouri:

The USDA Loan Map is a crucial tool for understanding whether a specific location in Missouri qualifies for a USDA loan. This interactive map, readily available online, allows users to input an address or zip code and determine if the area falls within the USDA’s designated rural boundaries. The map provides a visual representation of eligible areas, making it easy to identify properties that qualify for the USDA loan program.

Key Benefits of USDA Loans in Missouri:

The USDA loan program offers several distinct advantages to eligible homebuyers in Missouri:

- Lower Down Payment Requirements: Unlike conventional mortgages, USDA loans typically require a minimal down payment, often as low as zero percent for qualified borrowers. This significantly reduces the upfront costs associated with purchasing a home, making homeownership more attainable for individuals and families with limited savings.

- Competitive Interest Rates: USDA loans generally offer competitive interest rates, potentially leading to lower monthly mortgage payments compared to other loan programs. This affordability can make a significant difference in the long term, allowing borrowers to allocate more resources towards other financial goals.

- Flexible Credit Requirements: While credit history plays a role in loan approval, the USDA loan program tends to have more flexible credit requirements compared to conventional mortgages. This can be particularly beneficial for individuals with limited credit history or those who have faced past credit challenges.

- No Private Mortgage Insurance (PMI): Unlike conventional loans, USDA loans do not require private mortgage insurance (PMI). This eliminates an additional monthly expense, further reducing the overall cost of homeownership.

- Assistance with Closing Costs: The USDA loan program may offer assistance with closing costs, further reducing the financial burden on borrowers during the homebuying process.

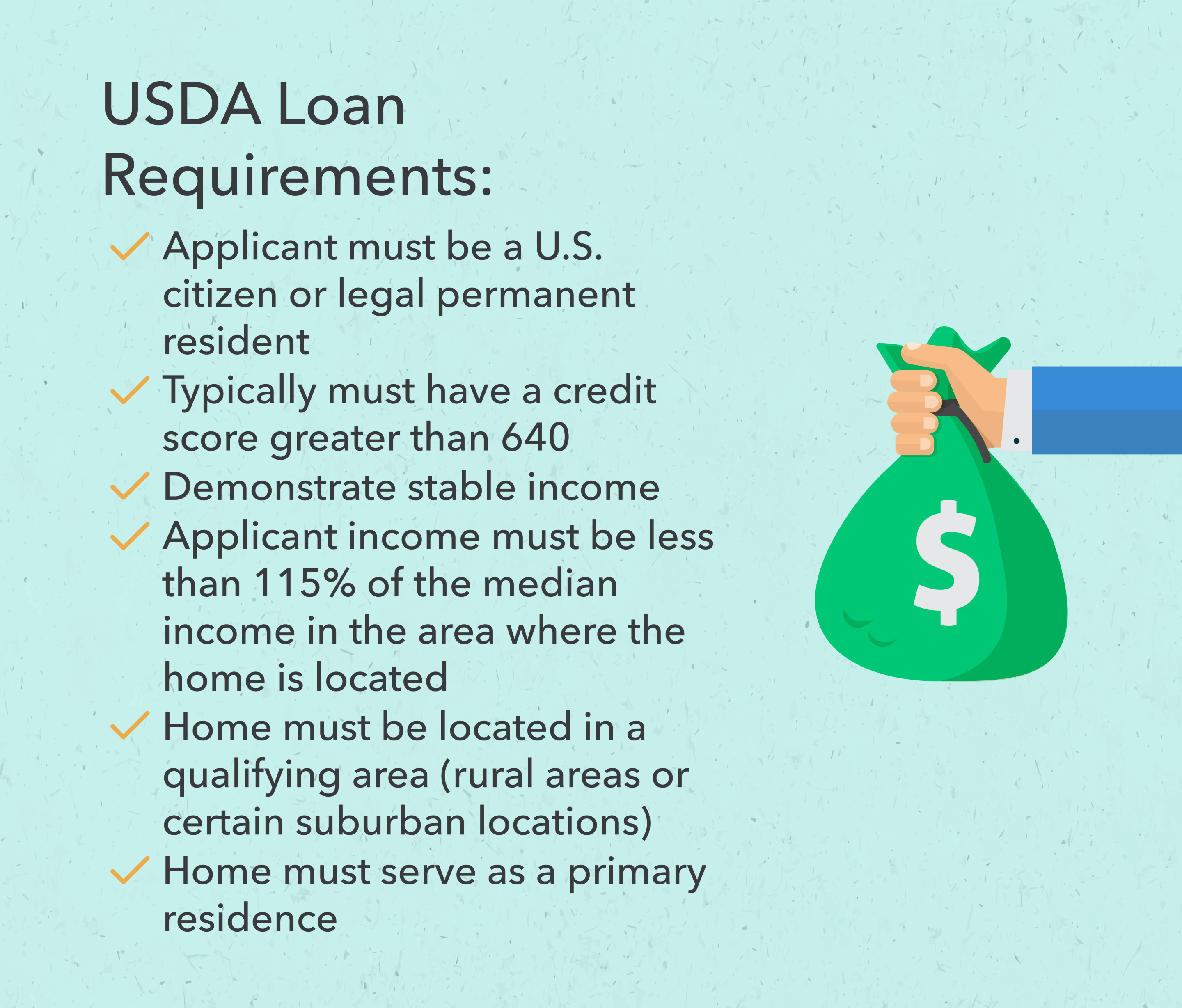

Eligibility Criteria for USDA Loans in Missouri:

To be eligible for a USDA loan in Missouri, applicants must meet specific criteria:

- Location: The property must be located in a designated rural area, as defined by the USDA Loan Map.

- Income: The household income must fall within the USDA’s income limits for the specific county where the property is located. These income limits vary based on family size and the county’s cost of living.

- Credit History: Applicants must have a satisfactory credit history, though the USDA loan program tends to have more flexible credit requirements compared to conventional mortgages.

- Debt-to-Income Ratio (DTI): The applicant’s debt-to-income ratio (DTI), which represents the percentage of monthly income allocated towards debt payments, should be within the USDA’s guidelines.

- Occupancy: The applicant must intend to occupy the property as their primary residence.

Understanding the Application Process for USDA Loans in Missouri:

The application process for a USDA loan in Missouri involves several steps:

- Pre-Approval: Before starting the application process, it is highly recommended to obtain pre-approval from a USDA-approved lender. Pre-approval demonstrates financial readiness and can streamline the loan application process.

- Finding a Property: Once pre-approved, applicants can begin searching for eligible properties located within designated rural areas in Missouri.

- Loan Application: Once a property is identified, applicants must submit a formal loan application to a USDA-approved lender. The application will require extensive documentation, including income verification, credit history, and property details.

- Property Appraisal: The USDA will conduct an appraisal of the property to ensure its value aligns with the loan amount.

- Loan Closing: Upon successful completion of the appraisal and other required steps, the loan will be closed, and the property will be transferred to the borrower.

Tips for Maximizing Success with USDA Loans in Missouri:

- Consult with a USDA-Approved Lender: Seeking advice from a qualified USDA-approved lender can provide valuable insights into the program’s intricacies and assist with navigating the application process.

- Thoroughly Research Eligible Properties: Utilize the USDA Loan Map to identify properties located within eligible rural areas in Missouri.

- Improve Credit Score: Prior to applying for a USDA loan, consider taking steps to improve your credit score, such as paying bills on time, reducing credit card debt, and avoiding unnecessary credit inquiries.

- Prepare Comprehensive Documentation: Gather all required documentation, including income verification, credit history, and property details, to streamline the loan application process.

- Stay Organized: Maintain meticulous records throughout the application process, including communication with the lender and any supporting documentation.

Frequently Asked Questions about USDA Loans in Missouri:

Q: What is the maximum loan amount for a USDA loan in Missouri?

A: The maximum loan amount for a USDA loan in Missouri varies based on the specific county and the property’s value. However, the current national maximum loan amount is set at $417,000.

Q: Can I use a USDA loan to purchase a fixer-upper property in Missouri?

A: Yes, USDA loans can be used to purchase fixer-upper properties, but they may require additional steps and documentation.

Q: What are the interest rates for USDA loans in Missouri?

A: Interest rates for USDA loans in Missouri are subject to change based on market conditions. However, they generally offer competitive rates compared to other loan programs.

Q: What are the closing costs associated with a USDA loan in Missouri?

A: Closing costs for USDA loans in Missouri vary depending on the property’s location and other factors. However, the USDA may offer assistance with closing costs for eligible borrowers.

Q: How long does it take to process a USDA loan application in Missouri?

A: The processing time for a USDA loan application in Missouri can vary based on factors such as the completeness of the application, the appraisal process, and other factors. However, it typically takes several weeks to complete the process.

Conclusion:

The USDA Rural Development Loan program presents a valuable opportunity for individuals and families seeking to achieve homeownership in rural Missouri. By understanding the program’s benefits, eligibility criteria, and application process, prospective homebuyers can navigate the path to homeownership with greater clarity and confidence. The USDA Loan Map serves as an essential tool for identifying eligible properties, while the program’s competitive interest rates, flexible credit requirements, and potential assistance with closing costs can make homeownership a more attainable goal. Through careful planning and preparation, individuals can leverage the USDA loan program to achieve the dream of homeownership in the beautiful and diverse landscapes of Missouri.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Path to Homeownership in Missouri: A Guide to USDA Loan Eligibility. We thank you for taking the time to read this article. See you in our next article!